Business

New capital gains regime to simplify tax system: CBDT Chairman

New Delhi, July 25

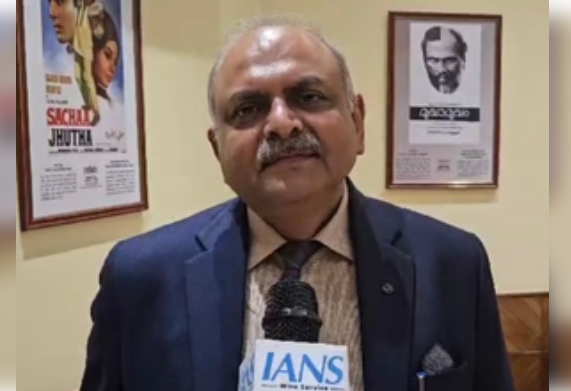

The new tax provisions and the capital gains tax regime will enable people to save more money than before and simplifying the tax assessment process will also provide relief to taxpayers, Ravi Agarwal, Chairman of Central Board of Direct Taxes (CBDT), said on Thursday.

Speaking to IANS, he said that the Union Budget 2024 would have a positive impact on the common people.

“In the new tax regime, income tax has been reduced and the standard deduction has also been increased. This will benefit the common people and they will save more money than before and be able to easily invest and spend somewhere,” Agarwal mentioned.

In the new tax regime, Income tax on income up to Rs 10 lakh has been reduced to 10 per cent, and standard deduction has been increased from Rs 50,000 to Rs 75,000.

On the new capital gain tax regime, he further said that under the new provision, capital gain has been standardised and made easier.

“Apart from this, sections like penalty prosecution have been decriminalised and tax assessment has been made easier,” said the CBDT Chairman, a 1988 batch Indian Revenue Service (IRS) officer from the income tax cadre.

On the new internship scheme, he said that it will help the youth a lot in moving forward and they will be able to go into the field of their interest.

On the 'Mudra' loan limit increase from Rs 10 lakh to Rs 20 lakh, he said that this will bring money into the economy and have a positive impact on employment and skills.

CBDT has also issued a detailed FAQs to explain new capital gains tax regime in Budget 2024-25.