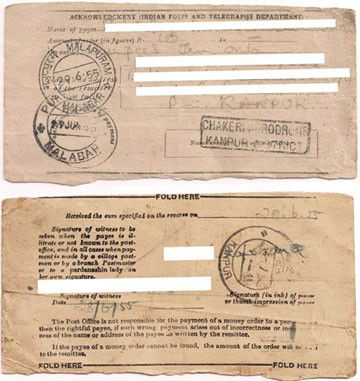

Articles features

End of a legacy: Money Order goes the telegram way

New Delhi/Mumbai/Kolkata, April 4

A

135-year-old legacy comes to an end! Like in the case of the telegram,

India Post has quietly discontinued the traditional money order service,

which was an integral part of the department since 1880, facilitating

pan-India door-delivery of funds to a payee from over 155,000 post

offices.

In an era of instant communications, the traditional

money transfer facility has made way for an electronic version, which

was introduced in October 2008, thanks to the proliferation of mobile

telephony and data communications in the country through the internet -

18 months after they led to the demise of the telegram.

"Yes, the

traditional money order as we know it has been discontinued," said

Shikha Mathur Kumar, deputy director general for finance with India Post

based in the national capital. "What we have now are electronic money

orders, or eMO, and instant money orders, or iMO, systems," Kumar told

IANS.

"Both these are much faster and simpler means to remit money."

The

iMO system, according to India Post, provides instant money order

service for amounts ranging from Rs.1,000 to Rs.50,000. An instant,

web-based system, money can be remitted by designated iMO post offices -

where an electronic version of a form is filled along with an identity

proof.

Once the money is transferred electronically, along with

one of the 33 standard messages that can be chosen by the remitter, the

payee can visit the post office and receive the money on producing a

proof of identity. The money can also be be credited to the savings bank

of a payee.

In the case of eMO, money is paid at the door-step

of a payee - from Rs.1 to Rs.5,000 - within a day, along with 21

standard messages. It is booked at an authorised post office and

delivered pan-India from all delivery post offices. This can also be

tracked on the India Post website.

But for many, especially the

senior citizens, the end of the traditional money system - which was

withdrawn from April - did evoke a sense of nostalgia and, to an extent,

some sadness as well.

"I would send money through money orders

to my family in a village Madhya Pradesh," recalled K. Abdulhussein, a

retired printing manager, now settled in Mumbai. "My folks back home

would wait for it. In fact, the village postman was an important man.

But what happens now," he wondered.

When the new, electronic

system of money order was explained, Abdulhussein told IANS that the

move was expected. "People today have two bank accounts - a salary

account and a personal account. Then there are mobile phones. Everyone

has it. So the old system had to go."

A similar sentiment was

shared by R.R. Pandya, a retired 80-year-old banker in Mumbai, who also

recalled having regularly sent funds through the traditional money order

system to his parents in Gujarat.

"They were more comfortable

dealing with the friendly neighbourhood postman. You had this option of

sending money with messages. So, during marriages, we would send Rs.11,

Rs.21, Rs.51 - along with congratulatory messages."

For Kanai Lal

Ghosh, a retired teacher in Kolkata, yesteryear memories and

contemporary India's reality present contrasting pictures. "I'd send

funds only by way of money orders to my parents. Now my son does it

instantly, from his mobile phone. I presume old ways are redundant now."

According

to information provided by India Post, the money order system was

transferred from the official treasury department to the Posts and

Telegraph Department in 1880 to save people the ardour of long journeys

they had to often undertake to pay revenues and rent.

This was

when Rai Saligram Bahadur, the second guru of the Radhasoami faith, was

the postmaster-general of the North-Western Provinces, based out of

Allahabad. He was the first Indian to hold that post and money order was

one of the many firsts he brought to the table.

From a mere 283

such transactions at that time, it grew to 108 million by the time the

service was in vogue for 100 years in 1980. The numbers dropped to

around 95 million when the eMO and iMO schemes were launched and even

further now, officials said.