Headlines

India assures foreign investors of a modern tax regime

By

Arun Kumar

Washington, April 17

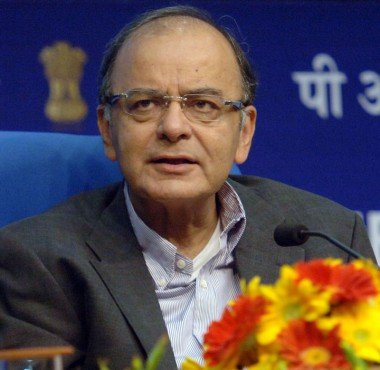

India's Finance Minister

Arun Jaitley has assured foreign investors that the government of Prime

Minister Narendra Modi was working on a more modern tax regime as part

of ongoing reforms to increase investment and reduce regulations to

realise double-digit growth.

“In order to realise double-digit

growth we need to undertake a number of reforms to increase investment

and reduce burdensome regulations. Key among them are taxes,†Jaitley

said in a speech at the Peterson Institute for International Economics

here.

Spelling out a tax vision for India at the leading think

tank on international economic issues, Jaitley said he believed that

with the reforms underway in India, “we are well on our way to having

one of the more modern tax systems in the world.â€

Noting that

India, “one of the bright spots in the economyâ€, is attracting the

attention of investors and policy-makers around the world because of its

rising growth prospects, he acknowledged investors' concerns about tax

related issues.

Outlining various reforms undertaken by the Modi

government, Jaitley said, “Fundamentally we have restored faith in

government and its ability to push the Indian economy toward the path of

sustained double-digit growth.â€

Spelling out his vision of a

modern 21st century tax system for India, Jaitley said the Indian

Parliament will pass a bill in the coming three weeks to implement Goods

and Services Tax (GST), a consumption-based value-added tax.

It

would, he said, create a broad tax base, strengthen revenues going

forward, increase the tax-GDP ratio, promote transparency, reduce

corruption and go toward creating an Indian common market because it

will replace a number of state-levied taxes.

India’s direct tax

system needs to catch up with the modern GST system, said Jaitley

noting, “Currently we have in some ways the worst of both worlds: high

marginal corporate taxes (35 percent) but low effective collection (22

percent).â€

“We create the perception of a high tax country and

yet do not collect commensurate taxes,†he said. “We need to change this

to promote investment and growth. At the same time we need to create

incentives for savings.â€

A long standing demand of the US

financial services industry, for allowing foreign investments in

alternative investment fund (AIF) structured has been introduced in this

year’s Budget, he said.

To simplify procedures for domestic

companies to attract foreign investments, the budget does away with the

distinction between foreign portfolio investments (FPI) and foreign

direct investments (FDI), and replace the separate 'carve-outs', Jaitley

said.

“This move is expected to attract more portfolio flows in the near to medium term in debt as well as equities,†he said.

“To

promote offshore funds, it has been proposed that the activity carried

out through an eligible fund manager located in India shall not

constitute a business connection for being taxed in India.â€

This clarification will help in relocation of fund managers in India, from Singapore and other such destinations, he said.

Turning

to foreign investors’ “concerns about retrospective taxation, tax

harassment, unpredictability and arbitrariness in tax administration,â€

Jaitley held out an assurance “that we are absolutely committed to a

transparent and predictable tax regime.â€

“There will be no

retrospective actions and we will see taxpayers as partners not as

potential hostages or victims,†he declared.

(Arun Kumar can be contacted at [email protected])